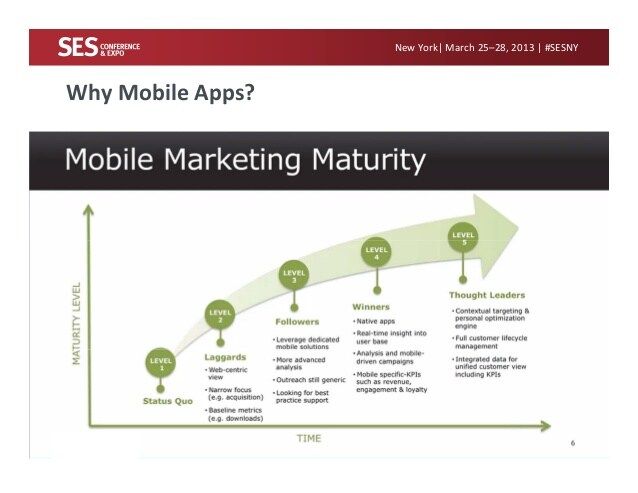

According to recent data published on eMarketer.com, carriers are going through a fundamental shift from depending on voice revenues for the lion’s share of their revenue to a mixed model where voice service is a commodity and most of the growth in revenue and profitability comes from the data side of the house. The NY-based research firm divides the consumer market into three major segments: entertainment, communications, and information. Things like mobile games, ringtones and other entertainment are currently running second as revenue drivers to texting and other mobile messaging. However, a new report from the New York-based research company projects that mobile entertainment will have the highest growth rate of any non-voice service in the U.S. through 2010. In fact, revenue from mobile entertainment will equal revenue from messaging by that time. This leaves information in the #3 position to communications and entertainment.

Here at Mobio, we agree with eMarketer.com’s conclusion that data is where the growth in the market will come from but – you knew there was a but coming didn’t you – we think they’ve missed the boat when it comes to segment sizing. Already, the industry is seeing softness in the entertainment category, with a marked drop in revenue from ringtones and wallpaper. What will pick up the slack? Information we think … but not the kind of passive information that sits on the web and gets mobilized through a WAP- or even an Opera mini-browser.

After all, information by itself has only limited utility while mobile. If someone can figure out how to deliver information and make it immediately relevant and actionable to consumers on the go … well that could open up the category in an entirely new and exciting way. Emarketer expects overall revenue from mobile data to reach $37.5 billion by 2010 … with $15M being spent on communications, $15M on entertainment, and $7.5M on information. We think these the marketing sizing for data in the US may be about right but the allocation by segment is just plain wrong. Anyone care to take any bets?